The Internet Giant, Google, will be announcing its third quarter earnings after the bell this Wednesday–October 17, 2013.

Here I’ll go over Google’s past few reports, what I’m expecting this time, and my reasoning behind shorting Google (gasp!).

–Consolidated Revenues(Quarterly)–

After being formally infused into Google’s business last year, Motorola has generated around $6.1B over the span of 5 quarters. Although impressive, the story lies deeper in Google’s surge of investments made in Motorola’s hardware and manufacturing infrastructure in America.

Over the last three quarters, Motorola’s revenues have declined from a relative peak of $1.51B to $998MM and this has weighed on its margins (which will be explained later.)

A booming business for Google is its brilliantly engineered ad-network, which is distributed across millions of web-sites, conveniently nested in a non-Google web-site’s screen real estate (e.g. StockTwits).However, revenue generated from this segment of Google’s revenue stream has been declining over the past three quarters from a relative peak of $3.4B (Q4) down to $3.1B (Q2), all while wall street analysts predicted network revenues to be well over $4B a quarter by now.

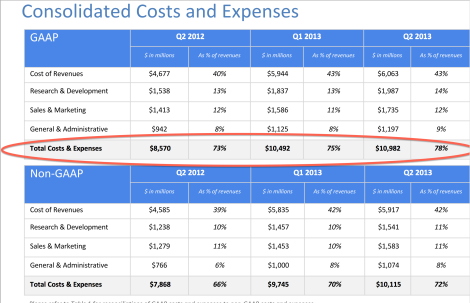

–Consolidated Costs and Expenses GAAP–

Google’s consolidated costs and expenses related to business activities has ballooned from 73% of revenues in Q2 2012 to 78% in Q2 2013. This reflects increased spending in: “primarily of manufacturing and inventory-related costs, data center operational expenses, amortization of intangible assets, and content acquisition costs…”.

As Google continues to challenge Apple, Amazon, and Microsoft by striving to become the one-stop online content-delivery network for its users via YouTube, Google Play, etc. Google will have to pay much more for the content its delivering– just as Amazon, Hulu, Netflix, Pandora, and Spotify have been doing for the past two years.

–Traffic Acquisition Costs–

As a percentage of revenues, Google has scaled extremely well by keeping TAC under 25% of advertising revenues. Over the past four quarters it has cost Google over $11.8B to acquire its growing traffic, which averages to around 25.3% of advertising revenues (slightly higher than Google’s historical average for TAC).

–Profitability Google-GAAP–

Google’s operating margins have declined over the past three quarters from 31% in Q2 2012 to 26% in Q3 2013. This reflects the increased spending on stock-based compensation across the board for its employees and the growing charges Google is faced with in its Motorola Mobility business segment.

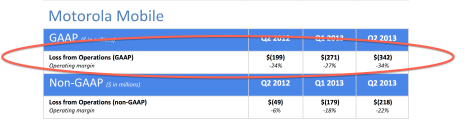

–Profitability Motorola Mobile-GAAP–

Google’s Motorola business has reported growing operating losses over the past three quarters, from $(199MM) in Q2 2012 to $(342MM) in Q2 2012. This reflects the growing stock-based compensation at Motorola, which has increased over three quarters from $9MM in Q2 2012 to $35MM in Q2 2013.

—What I’m Expecting—

Wall Street Estimates: $10.34/per share on $11.738B in revenues

Estimize Consensus: $10.58/per share on $11.822B in revenues

My estimate: $9.95/ per share on $11.450B in revenues

My estimate is below both the WS and Estimize consensus for the following reasons:

-Motorola’s revenues will remain slightly under $1B for the quarter

-Motorola’s operating losses will continue to weigh on Google, I expect -36% operating margins

-TAC costs will account for ~25.5% of advertising revenues

-Google’s GAAP total cost and expenses will go from 78% of revenues to 80% this quarter

-Net income from discontinued operations will fall from $674MM (sale of Motorola Home) to under $100MM

-Google’s exposure to “rest of the world” (excludes UK and US) will fall to $5.75B, this reflects consumer sentiment, FX rates, and GDP growth rates in other countries.

—Why I’m Shorting Google—

I’m shorting Google due to my expectations for the short term continued blip in Google’s earnings, a head & shoulders pattern, and overall market volatility.

Some risks to this trade:

-Congress passes a deal that makes everything dandy again

-Google reports numbers that blow my expectation out of the water

-Historically, Google has a 92% correlation with EPS surges and hiring sprees from 1 fiscal year ago.

My 3 month price target for Google is $750.

Mentioned below are fours ways in which a broker is able to help you get

a greater price for your business. Nevertheless, the reality proved that Apple is wrong.

For more of marketing and business technology tips visit us at Global IT Users ‘ The Marketing

and Technology Blog providing solutions to the Challenges you are facing in the IT Sector today and

find a change in the business activities you are doing.